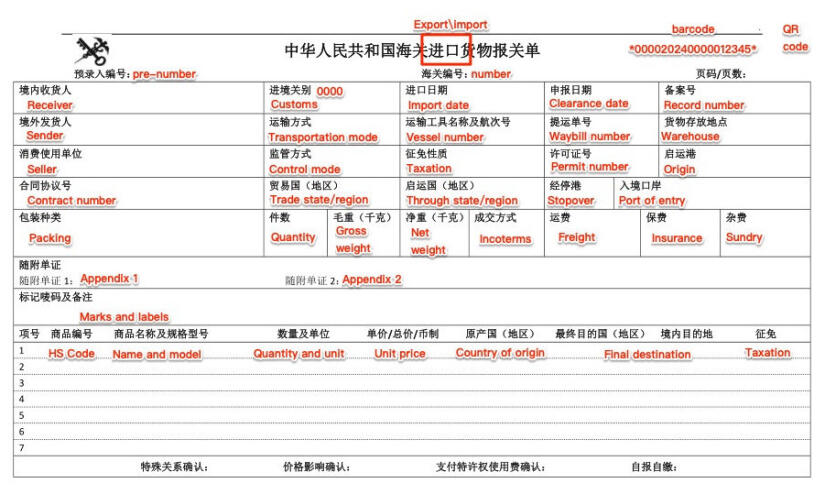

How to read a Chinese customs declaration

The Import/Export Declaration of the People's Republic of China (中华人民共和国海关出口/进口货物报关单) is issued when cargo crosses the customs borders of the People's Republic of China. In this article, we will look at the content of this declaration and explain how to read it.

- Name of the document. Export/import (进口/出口) - type of customs declaration, export or import

- Pre-number (预录入编号) - preliminary declaration number: *I 0000 2024 0 123456789* (import) or *E 0000 2024 0 123456789* (export)

- Number (海关编号) - customs declaration number

It is important to immediately note a key distinction: Chinese customs declarations can be either preliminary or regular. A preliminary declaration is a completed declaration that is ready for submission but has not yet been officially sent by the customs agent. At this stage, you can make any necessary changes. The purpose of the preliminary declaration is to verify the accuracy of the information with the sender or recipient before final submission. In other words, it is not yet considered an official document.

You can identify a preliminary declaration by the first character in the declaration number, which will be a letter: "I" for import and "E" for export. In contrast, the number of a regular declaration, which is an official document, will not contain any letters.

The structure of the declaration number is as follows:- The first 4 digits represent the customs port number.

- The next 4 digits indicate the year.

- The following digit signifies the type of declaration: 0 for export and 1 for import.

- The final 9 digits are the serial number of the customs declaration.

- Barcode and QR-code - customs declaration number in the form of 2D codes;

- Receiver (境内收货人) - recipient of the goods;

- Customs (进/出境关别) - import/export customs port number;

- Import/export date (进/出口日期) - date of import or export;

- Clearance date (申报日期) - date of registration of the customs declaration;

- Record number (备案号) - registration number, if the type of the cargo requires it;

- Sender (境外发货人) - sender of the goods. Sender and recipient fields will be swapped in the export declaration;

- Transportation mode (运输方式) - type of transportation;

- Vessel number (运输工具名称及航次号) - number of the vessel/ship/airplane carrying out transportation;

- Waybill number (提运单号) - waybill number;

- Warehouse (货物存放地点) - a warehouse where cargo will be stored after import. Usually a free trade zone or a bonded zone. Not applicable for export;

- Seller (消费使用单位) - seller of goods;

- Control mode (监管方式) - type of export control. If the goods are not subject to export control, for example, here there will be 一般贸易 (ordinary trade);

- Taxation (征免性质) - type of taxation. Standard, tax free and special available;

- Permit number (许可证号) - permit number allowing the transportation of special cargo, such as dangerous chemistry products, etc.;

- Origin (启运港) - the place where cargo transportation begins;

- Contract number (合同协议号) - number of the contract or invoice;

- Trade state\region (贸易国 (地区) - country\region when the contract was signed;

- Through state\region (启运国 (地区) - country\region through which transportation is carried out (in case the goods enter the country not directly, but through third countries). Never applies to air freight or sea freight, only to rail and road transport;

- Stopover (经停港) - is the customs area through which the cargo will be transported after import. Usually a free trade zone or a bonded zone. Not applicable for export;

- Port of entry (入境口岸) - customs point;

- Packing (包装种类) - type of packaging;

- Quantity (件数) - quantity of product;

- Gross weight (毛重 (千克) - gross weight (in kilograms);

- Net weight (净重 (千克) - net weight (in kilograms);

- Incoterms (成交方式) - applied Incoterms;

- Freight (运费) - cost of transportation (if this is implied by the applicable Incoterms);

- Insurance (保费) - the cost of insurance (if this is implied by the applicable Incoterms);

- Sundry (杂费) - miscellaneous expenses (if implied by the applicable Incoterms);

- Appendix 1 & Appendix 2 (附件单证) - attached documents on the basis of which customs clearance is carried out. Most often this is a single set of “contract, invoice and packing list;

- HS Code (商品编号) - customs code of goods in accordance with the "Customs Tariff of the People's Republic of China" and "Classification of goods for the purposes of Customs Statistics of the People's Republic of China";

- Name and model (商品名称及规格型号) - name and model of the product;

- Quantity and unit (数量及单位) - quantity of the product and its unit of measurement (for example, liters, meters, pieces, sets);

- Unit price (单价/总价/币制) - product price per unit of measurement, total price, currency;

- Country of origin (原产国) - country of origin of the product;

- Final destination (最终目的地, 境内目的地) - country of the final recipient of the goods, place of final destination;

- Taxation (征免) - type of taxation, levy and exemption;